The Uniform Commercial Code (UCC) is a set of laws and regulations that govern the details of a business operation. Due to differing state laws, the UCC code is the product of the increasing difficulty for businesses to do business across state borders. The Uniform Commercial Code (UCC) is significant because it provides a common legal and contractual structure that allows businesses in various states to trade with one another. Most states in the United States have fully embraced the UCC legislation. Although there are some minor differences from state to state, the UCC code has nine articles. Different kinds of transactions, such as banking and loans, fall under the UCC articles.

Here are some of the notable points about UCC:

- The Uniform Commercial Code (UCC) is a set of state-by-state commercial rules that govern financial contracts and transactions.

- The UCC code has nine articles, each of which deals with a different element of banking and loans.

- The Uniform Commercial Code applies to businesses that undertake business outside of their native state (UCC).

Most states have fully accepted the UCC code, while others have made minor changes.

What is a UCC Financing Statement?

Our friends from Kira Systems defined UCC Financing Statement as follows:

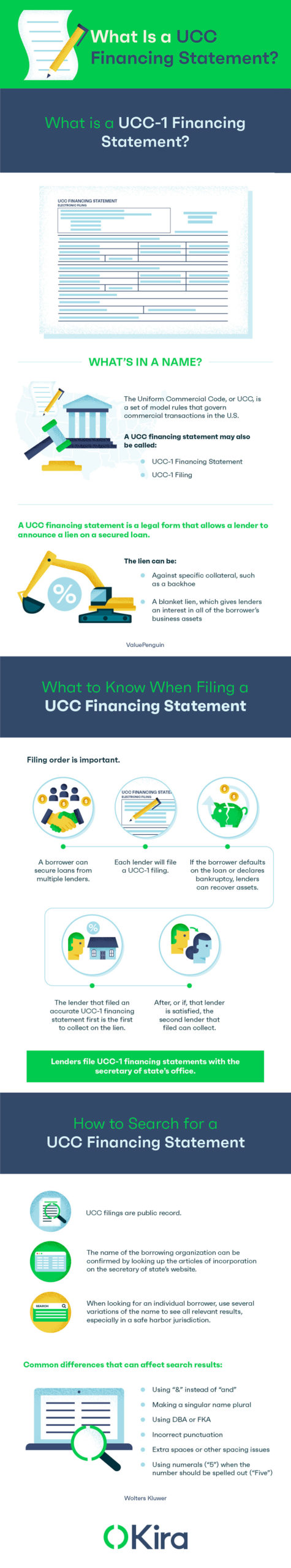

A UCC financing statement — also called a UCC-1 financing statement or a UCC-1 filing — is a legal form that allows a lender to announce a lien on an asset to secure a loan. By filing the UCC financing statement, the lender is giving notice that it has an interest in the property listed in the filing.

The filing of a UCC financial statement creates a hierarchy of which assets can be seized, and in what order, should the debtor default or declare bankruptcy. For instance, if a borrower takes out another loan from a second lender using the same assets as collateral, the second lender will not be permitted to recover the assets until the first lender is fully satisfied.

If you wish to learn more about the peaks and valleys of a UCC-1 Financing Statement, please refer to the infographic below or you also can visit (https://kirasystems.com/learn/what-is-a-ucc-financing-statement/) for the complete article about UCC Financing Statement.

Having a thorough grasp of the procedures for filing UCC financing statements is important. Also, becoming attuned to the consequences of filing the statements incorrectly, is essential for acquiring and collecting commercial loans. At Bankers Advocate, we are aware of the necessary procedures in order to acquire commercial loans. This is why this article from Kira Systems is extremely helpful. It provides businesses and individuals with the right information about UCC financing statements.

Share Via: